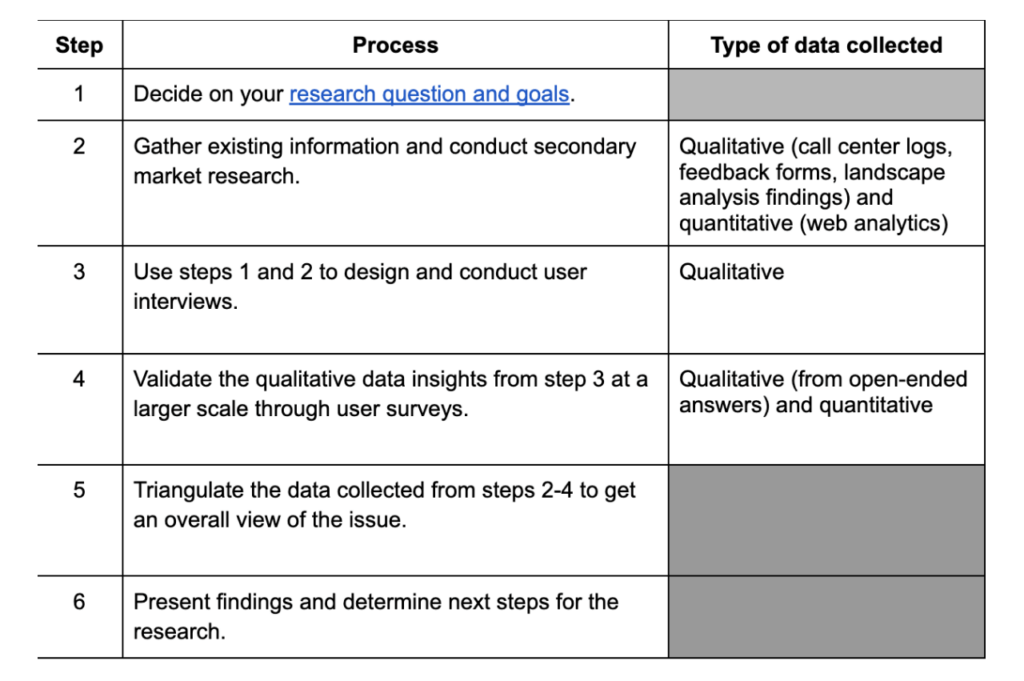

Let’s illustrate the theory with an example and assume that our company is planning to launch some meal subscription plans. We want to conduct research to understand how this product should be designed.

Our research question might look like this: How do people plan their meals for the week?

Based on that, our research goals might look like these:

- Uncover people’s decision-making process behind meal planning

- Learn about the current tools they use and any pain points and frustrations they face

- Understand their goals and motivations for meal planning

Looking at customer data, we realise that new subscriptions are highest around August-September, but subscription cancellations and pauses occur around November-December. Although no one knows the reason(s) behind these data trends, you now have some ideas of questions you can ask in your discussion guide!

Our user interviews indicate that most people have recipes in mind first before they go grocery shopping, but some people only decide on the ingredients to buy after seeing what is on sale. We also find that two frustrations people face with meal subscription kits is the lack of instructions on basic cooking terminology (what on earth is medium heat versus high heat?) and the inability to see what meal subscription kits on a long time horizon (people want to be able to plan on a monthly, not just a weekly basis). We also find that people hit pause on their subscriptions around November-December because they are travelling or hosting friends from out of town.

Now, we can validate these findings at a wider scale, with surveys sent out to screened participants who both grocery shop and subscribe to meal plans. Some questions we could ask include:

- What is the biggest frustration you face with meal subscriptions?

- Lack of instructions on basic cooking terminology

- Not being able to see what meals are offered on a monthly basis

- Can’t change my plans easily

- Other

- What is the main reason for you pausing meal subscriptions?

- Travelling

- Hosting friends from out of town

- Not interested in the current meal-plan line-up

- Other

- Which method best describes how you shop for food?

- I plan what recipes I want to cook first before grocery shopping.

- I look at online ads to see what’s on sale, then plan my recipes and grocery shop.

- I go to a grocery shop, see what’s on sale, and then plan my recipes from that.

- I have an idea of recipes I want to make, but make adjustments based on what I see on sale when I go into a store.

- I have no plan, I just buy whatever ingredient looks good.

- Other

From our survey, we find that not being able to see what plans are offered on a monthly basis is the biggest frustration and this aligns with our landscape analysis, which shows that all current companies only offer meal subscription plans on a weekly basis. We also find that most people pause meal subscriptions because they are travelling.

These lead to two exciting research possibilities. We can design a variety of meal subscription plans (monthly and biweekly) to better determine the most popular prices and subscription content. We also have a new UX product strategy to explore – could we partner with Airbnb to offer curated meal kits with local ingredients for various travel destinations?